EDITORIAL: Student loan freeze didn’t help borrowers shed debt

President Joe Biden is already scheming to get around last week’s Supreme Court ruling that invalidated his effort to unilaterally make billions in student loan debt disappear. If Plan B involves more executive branch legerdemain not authorized by the Constitution — the details remain murky — expect another legal challenge.

In the meantime, the administration should consider whether the 40-month “pause” on loan payments — implemented during the height of COVID and extended nine times — succeeded in easing the financial burden that hit many borrowers during the pandemic. At least one study finds the opposite.

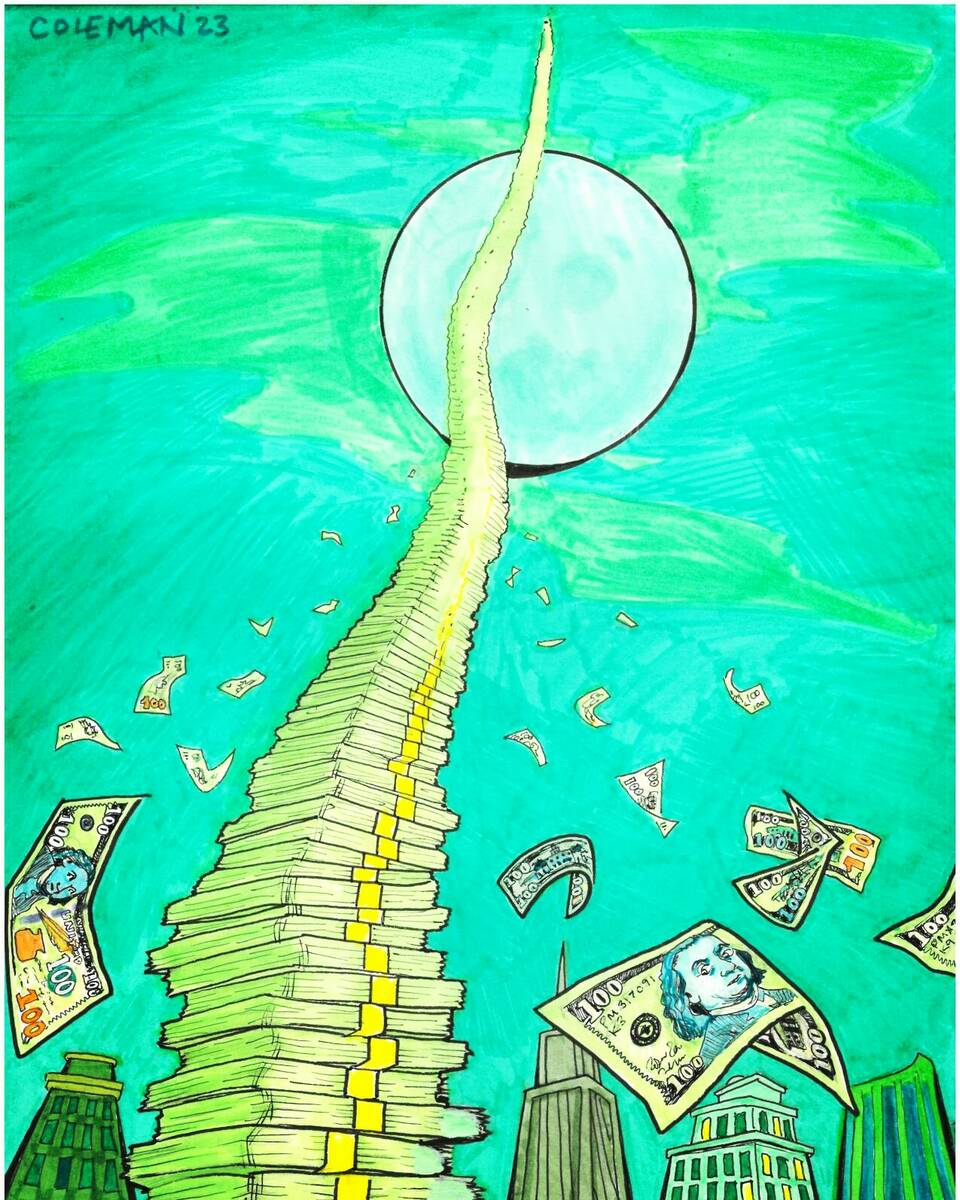

A University of Chicago analysis published last month found that student loan recipients who stopped payments increased their overall debt burden because they “sharply increased mortgage, auto and credit card borrowing.” On average, those who took advantage of the payment moratorium added an additional $1,500 in consumer debt.

“We show that borrowers used the new liquidity to increase borrowing on credit cards, mortgages and auto loans rather than avoid delinquencies,” researchers from the university’s Becker Friedman Institute for Economics concluded, finding that “perhaps paradoxically, temporary student debt relief leads to higher overall household debt levels and larger future debt burdens.”

The purpose of the payment pause was to provide a breather to borrowers struggling during COVID, not to encourage them to rack up more debt. In fact, going deeper into the red too often compounds financial ills. Indeed, the New York Times reported, “In recent months, the (University of Chicago) paper found, those borrowers have started to become delinquent on their loans at higher rates — raising the concern that the resumption of student loan payments could drive more of them into default.”

But whose fault is that? Why doesn’t a borrower have some personal responsibility to make good on his or her obligations?

In addition, the study doesn’t even address the fact that borrowers who haven’t made payments for more than three years are now that much further away from getting out from under their student loans.

To be sure, a once-in-a-lifetime pandemic and the economic havoc and uncertainty it wrought called for unusual measures. A student loan freeze was a reasonable short-term response. But to keep such a policy in place for months — even years — after the economy bounced back was an expensive mistake. Not only are many borrowers worse off than before the pause, the American taxpayers are out $5 billion for every month Mr. Biden extended the payment suspension. It was lose-lose.

This commentary was originally published by the Las Vegas Review-Journal.