EDITORIAL: No taxes on tips? Watch for unintended consequences

Donald Trump stormed through Las Vegas last weekend, holding an outdoor rally Sunday at Sunset Park. To nobody’s surprise, the presumptive Republican presidential nominee, who narrowly lost Nevada in both 2016 and 2020, went looking for votes from hospitality workers.

“For those hotel workers and people that get tips, you’re going to be very happy, because when I get to office, we are going to not charge taxes on tips,” Mr. Trump said, adding, “We’re going to do that right away. … You do a great job of service.”

Americans should indeed be allowed to keep more of the money they earn. One of the signature achievements of Mr. Trump’s first term was the successful passage of a tax reform bill that lowered income taxes for the vast majority of Americans and simplified an overly complicated IRS code. Democrats reflexively blame tax reductions for soaring deficits and the debt. But Washington doesn’t have a shortage of revenue. It has a spending problem.

That debate aside, Mr. Trump’s proposal for tax-free tip income may be a tempting road as a means of putting more money in the pockets of middle class and low-wage workers. Some Democrats may even support the idea. But absent details, it’s difficult to analyze the unintended consequences, which are likely to be significant. And it’s virtually impossible that Mr. Trump would be able to pull it off “right away.”

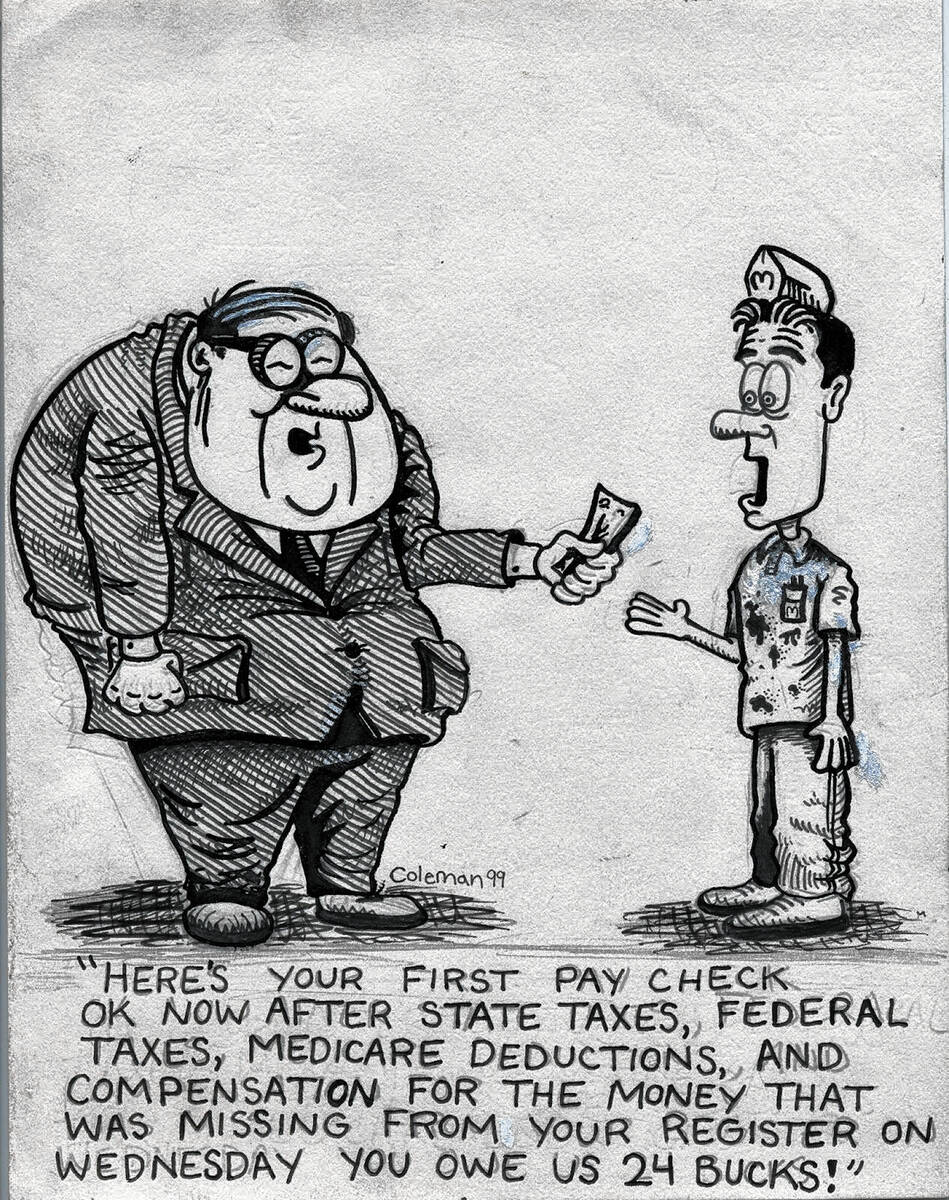

“The proposal would create a two-tiered wage market where tipped workers would gain a significant advantage over other low-wage employees,” the Wall Street Journal reported, “because they could potentially avoid Social Security taxes, Medicare taxes and federal income taxes.”

The shift could lead to an explosion in the number of workers seeking to be paid via tips, and it could create an incentive for employers to shift workers to such a compensation model — even in industries where tipping is currently rare. The marketplace tends to take advantage of tax code loopholes intended to promote a political or social objective.

In recent years, the IRS has expanded tip compliance programs intended to encourage reporting. The explosion of electronic transactions has also made it more difficult for employees to avoid the tax man when it comes to tips. Still, the IRS reports that about 45 percent of all tip income remains unreported.

Democrats have vowed to let Mr. Trump’s landmark 2017 tax bill expire in 2025. If Mr. Trump wins a second term, he will need to devote plenty of political capital to preserving that landmark legislation, particularly if Republicans don’t gain control of the Senate.

If Mr. Trump wants a debate on exempting tip income, great. But first he should focus on saving one of his signature achievements.

This commentary initially appeared in the Las Vegas Review-Journal.