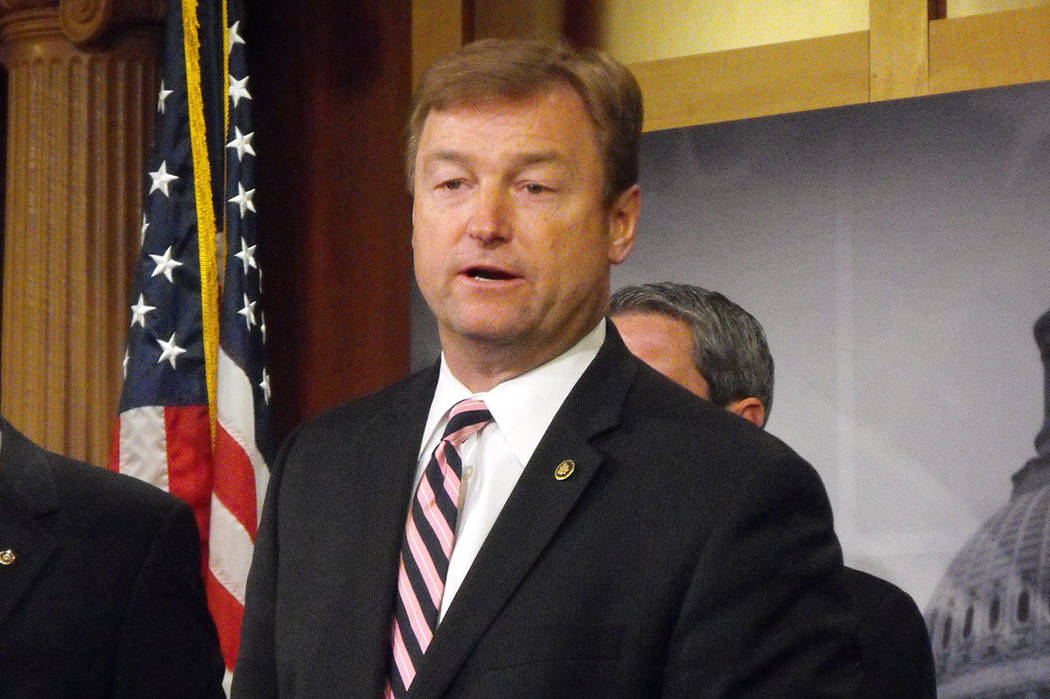

Nevada’s Dean Heller and GOP on cusp of passing tax reform

U.S. Sen. Dean Heller and other House and Senate GOP leaders could be within days of passing a final bill to overhaul the federal tax code, with legislation potentially heading to the White House by the holidays.

The final vote for the Senate is expected on Tuesday, with the House taking action soon after on a bill called the Tax Cuts and Jobs Act, Heller said on a phone call with rural Nevada newspapers, including the Pahrump Valley Times, on Dec. 13.

Heller, R-Nevada, discussed key events going on in Washington D.C., including tax reform.

GOP leaders came together on Wednesday to iron out the differences between the House and Senate versions of the tax reform bill in a conference committee, reaching a tentative deal.

Some of the compromises included reducing the corporate tax rate, previously planned to be 20 percent, down to 21 percent. The final agreement also pushed the top individual tax rate to 37 percent. The Senate’s prior version put the rate at a proposed 38.5 percent, with the House proposing 39.6 percent.

What it means for Nevada

Heller is expecting major gains for the economy over the next several years if the legislation gets through Congress.

“We need to grow the economy, we need to increase wages and we need to make American companies competitive worldwide,” Heller said. “That was the premise of this legislation.”

According to data from Heller’s office, sourced from the Tax Foundation, a right-leaning think tank, passing the bill could create 8,300 jobs in the state, along with boosting middle-class income, the report said.

The analysis, however, was released on Nov. 10 and based on a previous version of the Senate’s tax plan. Heller said he needed to do another analysis of the numbers, depending on what was worked out in the final bill. But he expected the job growth numbers to stay generally the same.

Heller said he also worked to increase the child tax credit provision in the bill from $1,000 to $2,000.

A closer look

Reached after the Heller conference call, Stephen Miller, director of the University of Nevada Las Vegas Center for Business and Economic Research, said the bill will “probably stimulate growth in the short run.”

“But in the long run, it should not generate much growth,” he said. “Since the tax bill had this limit of $1.5 trillion in additions to the deficit, the sun-setting of the personal tax cuts was to achieve that target.”

Heller said that if the tax bill was to be implemented, a family of four with a $55,000 income would see about a 35 percent decrease in taxes.

That number would decrease to a 20 percent reduction in taxes for a family of four making over $100,000, with an 8 percent reduction for families making over $150,000, he estimated.

Analysis by the New York Times on Nov. 10, when the Senate tax plan was first unveiled, showed about one-quarter of families in the middle class could see a tax increase in 2018. That number was pegged to increase by 2026 to about one-third of the middle-class population.

The report defined middle-class earners as those earning between two-thirds and twice the median household income: $50,000 to $160,000, per year for a family of three.

Under the House bill, the Times estimated half of this population would pay more in taxes by 2026.

Miller didn’t think the economy needed stimulus that would add to the federal deficit.

“The national economy is already at capacity. CBER’s forecast puts the national economy above capacity from now through the end of 2019,” he said. “The Fed’s action to raise interest rates today and three times in 2018 is designed to head off any excess inflation due to an overheating economy.”

“Thus, we really do not need a fiscal stimulus with an increase in the government deficit,” Miller said.

Heller maintains that the plan will make the U.S. more competitive.

In fact, he said that if the plan had been implemented a decade earlier, there would be about 5,100 other large businesses that would have chosen to stay in the U.S. instead of going overseas.

Overall, Heller sees the bill growing the economy across the country and Nevada, along with making the nation more competitive on the world stage.

Contact reporter Jeffrey Meehan at jmeehan@pvtimes.com