Carol Mayorga: 10 reasons to get smarter about your credit scores

Did you know that a good credit score can help with more than borrowing? A good credit score can factor into everything from getting a cell phone, buying a car, obtaining a student loan, and renting an apartment. Lenders, landlords and utility providers can all review credit reports.

Because credit can play an important role in your day-to-day life, establishing good credit habits is essential to help build, maintain or improve credit. Here are 10 tips to help you learn more about good habits and get smarter about credit:

1. Monitor your credit regularly: Make sure you stay on top of your children’s and your own credit history. Be sure to check all three credit bureaus annually for free through www.annualcreditreport.com.

2. Good scores = good rates: Better credit scores may get you better credit interest rates.

3. Know your credit limits: Being close to or maxing out your credit limits may negatively impact your credit score.

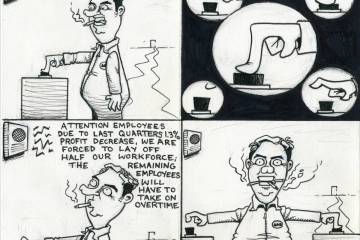

4. Don’t be late: Missed payments have the largest impact on a credit score, so don’t skip payments. If you are late, don’t be 30 days late, and if you have difficulty making payments, call your lender.

5. Know your debt-to-income (DTI) ratio: This is your total recurring debt divided by gross income. Lenders look at the amount of debt you have compared to your monthly income.

6. Start with a college or secured credit card: If you need to establish credit, a secured credit card, or if you are a college student, a college credit card may be a good way to start.

7. Pay down highest interest rates first: When trying to pay down your existing debt, pay down your highest interest debt first.

8. Pay more than the minimum: Paying more than what’s due on your credit card helps you pay down debt faster and may improve your credit score.

9. Live within your means: By setting a budget and living within your means, you may avoid using credit to overextend yourself.

10. Set up alerts: Set up email and text alerts, and consider autopay to help ensure that you pay your bills on time and build positive credit history.

On Thursday, Oct. 18, volunteers from Wells Fargo and other banks across the country will be visiting classrooms and working with young people as a part of the American Bankers Association’s (ABA) Get Smart About Credit Day.

It’s an important first step towards developing financial capability, and Get Smart About Credit is the perfect time for parents to continue the conversation at home.

Although the ABA celebrates Get Smart About Credit Day on one day, Wells Fargo encourages everyone to have a conversation about credit throughout the entire month of October and make credit education a part of our daily conversations year round. For additional resources, visit Wells Fargo’s engaging, interactive and free Hands on Banking® program. The non-commercial online curriculum is easy to use and lessons are specifically tailored by age-group. (There are lessons for adults as well.)

Building credit and maintaining a good credit history are the keys to your family’s financial future and your financial health. Identifying at least one thing you can be doing differently to improve your credit means you’re taking a great step in the right direction toward financial stability and success.

Carol Mayorga is a district manager for Wells Fargo in Southern Nevada. As a public service, Wells Fargo provides the Hands on Banking® program – it’s free and fun financial education without commercial content.