Victor Joecks: Tax cuts increased take-home pay of Rosen’s campaign staff

In February, the campaign team of Democratic U.S. Rep. Jacky Rosen saw a pay bump — thanks to the Republican tax plan.

Rep. Rosen is challenging U.S. Sen. Dean Heller, and she has repeatedly voiced her opposition to the tax cuts Republicans passed last year. The tax cuts will “increase the economic anxiety of too many Nevada families at their kitchen tables,” she wrote in November. In December, she called it a “disastrous tax scheme” and accused Heller of raising taxes on “hardworking Nevadans.”

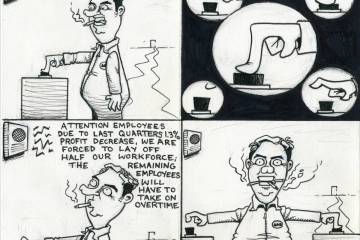

Given their refusal to return phone calls seeking comment, it’s debatable whether Rosen’s staff qualifies as “hardworking.” What’s not debatable is that Rosen’s FEC report shows their take-home pay increased in February 2018. That’s when new IRS withholding tables — which reflected the new tax law — went into effect. An example on the FEC website advises that campaigns should separate out an employee’s take-home pay from the taxes withheld by the campaign. This allows you to see differences in take-home pay.

Rosen pays her staff twice a month, although at the end of each quarter, she pays her staff at the beginning of the next month. That artificially boosts her cash on hand for reporting purposes.

Rosen’s highest-paid employee is campaign manager Daniel Kazin. From Oct. 1 to Jan. 31, his bimonthly paycheck was $5,353. Starting Feb. 15, his paycheck jumped to $5,555. That’s a 3.8 percent increase worth more than $4,800 a year.

It wasn’t just Kazin. Every single Rosen campaign employee who was on salary in January and February saw a pay bump. Helen Smith saw the highest pay boost by percentage. Her check went from $2,222 to $2,313, a 4.1 percent increase. That increased her net pay by more than $2,100 a year.

Even Rosen’s lowest-paid employee, August McGinnity-Wake, saw benefits. His paycheck jumped from $1,077 to $1,093, a 1.5 percent increase. That’s worth $384 a year.

Yet to the public, Rosen and her staff continue to bemoan the tax cuts. In April, her communications director, Stewart Boss, tweeted that the “GOP tax bill didn’t benefit American workers.” In December, he tweeted that “regular people get crumbs, or tax hikes.”

Boss’ paycheck, however, told a different story. In February, it increased by 3.7 percent, going from $2,744 to $2,847. The Republican tax cut plan boosted his take-home pay by more than $2,400 a year.

These facts fly in the face of Rosen’s rhetoric, but despite the mainstream media’s spin, the Republican tax plan cut taxes for most people. Ironically, the individuals most likely to see a tax hike from tax reform are rich people who live in high-tax states such as California and New York. That’s because tax reform capped the state and local tax deduction at $10,000. You know who pays more than $10,000 in state and local taxes? The rich.

This has the Democrats who run high-tax states in a panic.

The unlimited deduction for state and local taxes acted as a federal subsidy for their state’s high levies. Now that the rich — including the “1 percenters” liberals so often revile — have to pay the full cost, Democrats are worried they’ll move. So leftists, including Democrat governors in New York, New Jersey and Connecticut, have created loopholes for millionaires seeking to avoid higher federal taxes. The IRS has already warned states about such schemes, but Democrat leaders are so eager to help to the rich avoid paying taxes, they’re trying anyway.

Think about where that leaves Democrats such as Rosen. They’re stuck attacking tax cuts that are putting more money in the pockets of working Americans — including her own staff — but are raising taxes on the rich in blue states.

No wonder Rosen’s been able to raise so much money in California.

Victor Joecks is a columnist for the Las Vegas Review-Journal.