Inside the rush to make Nevada the country’s lithium capital

ESMERALDA COUNTY — Navigating the winding dirt path that may soon be paved for autonomous cars at Rhyolite Ridge is an easy feat for Bernard Rowe. He knows the prehistoric landscape well — and envisions its imminent, dramatic change better than anyone.

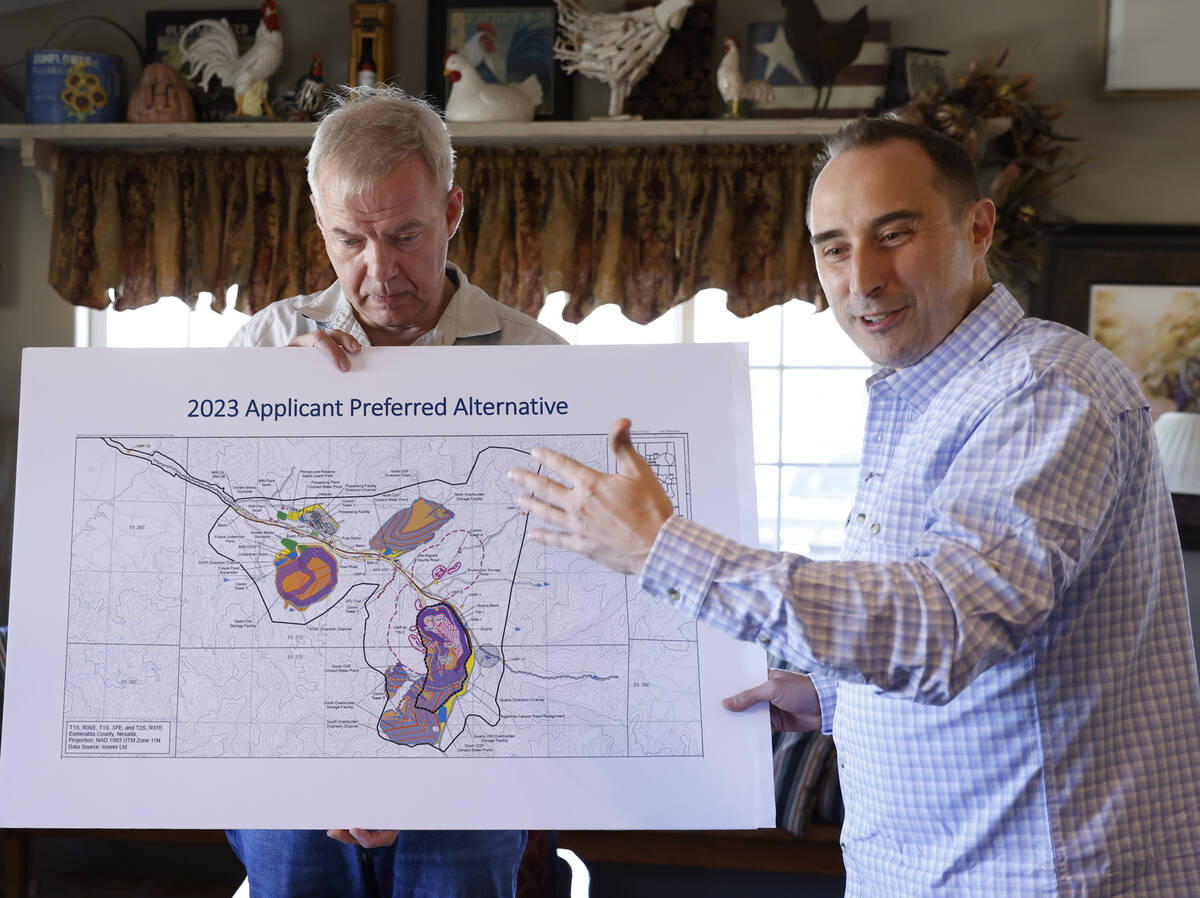

Rowe, a geologist and managing director of Australian mining company Ioneer, is one leader at the helm of Nevada’s lithium revolution. Since 2016, he and his company have invested more than $172 million in permitting a project in central Nevada’s Esmeralda County, about 65 miles southwest of Tonopah.

“You need to use your imagination,” Rowe told the Las Vegas Review-Journal, with ancient, multicolored mountains behind him that formed from once-active volcanoes. “But look around you: Basically everything here has lithium and boron, but it’s below us.”

About 6 million years ago, Rhyolite Ridge was under water. A lake about 1,000 feet deep dried up over time, leaving behind lithium- and boron-dense soil. It’s one of two deposits like it in the world.

The Ioneer project is one of more than 80 lithium mine proposals environmentalists are tracking, many of which are making their way through a lengthy permitting process, while accounting for shrinking availability of groundwater and potential effects to wildlife.

The Review-Journal recently toured the site to learn more about what could be at stake.

Lithium’s untapped potential

Lithium, which is used in the batteries found in electric vehicles, fits into the Biden administration’s clean energy transition, perhaps best exhibited through the Department of Energy’s first-of-its-kind conditional loan of up to $700 million for Ioneer’s project.

Nevada could be at the center of that change.

The lithium at Rhyolite Ridge is high-grade, too: Company leaders say it could produce 22,000 tons of lithium per year, which translates to the amount needed for roughly 370,000 electric cars. In its permitted area, it has enough lithium for 50 million electric cars, said Chad Yeftich, Ioneer’s vice president of corporate development and external affairs.

Mining companies like Ioneer hope to create a domestic supply chain of lithium in the U.S. The country produces less than a mere 2 percent of the world’s lithium, despite having more than 3 percent of the world’s reserves, according to the Institute for Energy Research.

Even though there has been interest in developing mines in Nevada over the past few decades, only one mine has made it through the extensive permitting process — Albemarle’s Silver Peak, of which operations lie on the other side of the mountain range.

Death by wildflower

In many ways, Nevada’s so-called lithium rush isn’t a race at all.

There are many bureaucratic hurdles a mining project can take upward of a decade to clear to ensure it won’t cause significant risk to surrounding residents, wildlife and water basins.

Ioneer’s mineral ambitions have largely been stifled by Tiehm’s buckwheat, a now-federally endangered wildflower that can only grow in the area’s lithium- and boron-dense soil.

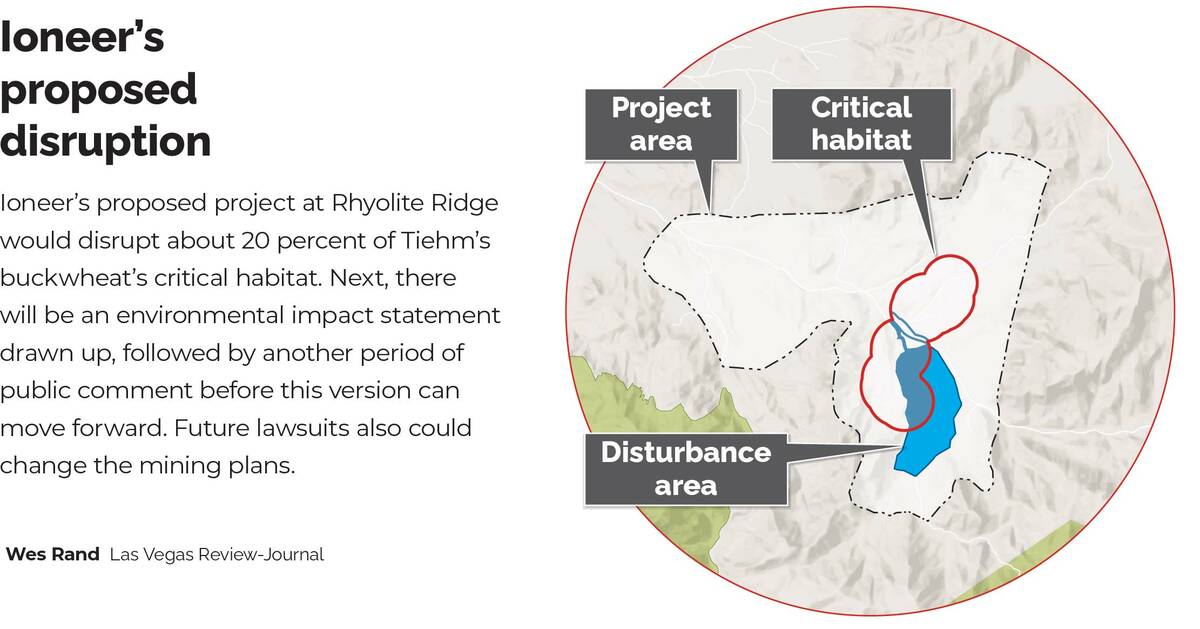

Rowe, of Ioneer, said the mining plan has evolved to provide “no direct impact” to the plant, though it would disrupt about 20 percent of what the U.S. Fish and Wildlife Service has designated as critical habitat.

In January 2023, the Bureau of Land Management cited Ioneer for trespassing through this habitat. During a media tour Feb. 22, company officials walked journalists through some of that area.

There’s heightened interest in the state’s deposits across the world, as shown by Forbes’ declaration of Ioneer as the “Moral Miner” on one of its February covers for trying to minimize impact to the plant.

Patrick Donnelly, Great Basin director for the Center for Biological Diversity, has been at odds with the company for years over what he and many botanists feel is a lax approach to conserving the plant.

The small flower blooms yellow in the warmer summer months. To Donnelly, the fight to preserve it is part of an effort to prevent a larger disaster that could wipe out tens of thousands of species throughout the world.

“We keep pulling pieces out of the Jenga tower with every extinction,” he said. “At some point, the Jenga tower collapses, and we don’t know when that is. The extinction crisis is happening right here in Nevada, and Tiehm’s buckwheat is the poster child.”

The current projection for habitat disruption is still egregious, Donnelly said, and the center has plans to bring the fight back to court if that doesn’t change, which could cause further delays.

“I will gladly sue them over losing 20 percent of critical habitat,” he said. “And we will definitely win.”

A miner’s water woes

Nevada’s lithium revolution is complicated by a fact of life in the state — it’s the driest in the country, and rights to pump groundwater can be hard to come by.

In mining both lithium and boron, Ioneer has touted its goal of recycling about 50 percent of the water used in the process, capturing steam and re-condensing it to again distill the minerals to their purest form.

Ioneer, which has told federal agencies that it has secured all the water it needs for the project, plans on constructing a pipeline up to the site to pump groundwater from the surrounding Fish Lake Valley. There’s an undetermined amount of groundwater available at the site already, but the company says it’s too early to tell how much there will be.

The company is allowed to pump 484 acre-feet, or roughly 157 million gallons, because of a lease agreement with a nearby farmer. White Mountain Ranch owner Brad Brown, who declined to comment for this story through his consulting agent, sold his farm’s rights to pump that water from the aquifer over the course of 10 years.

That means Ioneer is accounting for at least some of its potential strain on the ever-shrinking aquifer, choosing to use an amount of water that Brown would have used anyway.

Brown is one of many farmers who may choose to siphon off their water rights temporarily to mining projects rather than participate in state programs designed to retire them permanently and reduce over-pumping.

But what Brown gave Ioneer is only a fraction of how many acre-feet of water may be needed to see the project to completion — at its height, it would need 4,100 acre-feet per year, or 1.3 billion gallons.

Though Rowe declined to share how much his company paid for the ranch’s water rights, he said Ioneer negotiated a fair rate. Through a representative, the company also declined to share where the rest of the water rights have come from, but said it has been in negotiations with multiple rights holders since 2017.

“Each water rights holder has requested confidentiality,” the company wrote.

Scoping public opinion

Generally, Esmeralda County residents have looked at the project as a necessary economic driver to a rural area.

A so-called “public scoping” process, where organizations and residents were invited to comment on the proposal, culminated in a final report in March.

“Getting a mine near your community is the best thing that can happen,” said Dave Shaddrick, president of the Nevada Mineral Exploration Coalition that expressed support for Ioneer’s project. “When a mine comes in, it creates jobs, it puts kids through college, it pays for school. It’s a tremendous benefit to the community.”

One unnamed person expressed concern over whether the mine would have an effect on domestic well water that nearby residents rely on, but company leaders told the Review-Journal they don’t anticipate any connection between their pumping and wells.

Through the process, mining oversight group Great Basin Resource Watch has raised concerns about the mine’s proposed pit lake and what’s known as its “spent ore storage facility,” Executive Director John Hadder said.

Pit lakes are relatively common in Nevada. Once a mining project has lived past its life, water bubbles up from the aquifer and fills it. The current mine plan proposes that it be 170 feet deep.

Hadder said it’s unclear, however, whether Ioneer’s will be a “flow-through” pit lake, which would allow contaminated water to pass through the aquifer rather than the water evaporating.

Ioneer’s water pollution permit through the state says its risk assessment has accounted for any long-term impacts, and the company said the pit lake will be solely evaporative rather than flow-through.

The permit also says the spent ore storage facility will not drain any of the highly toxic waste it will accrue; rather, it will be evaporated. Still, Hadder remains concerned about the liner that is supposed to prevent any spillage of waste.

“Are we talking about collecting liquid for 50 years, 150 years? How long?” Hadder said. “Is there going to be money available to pay for that? And what happens if there’s a catastrophic failure?”

Nevada’s extractive future

Once the project in its initial form is completely permitted, Ioneer officials say they intend to expand. But first, this version of the project must undergo an environmental review where there will be more opportunity for public comment.

Overall, there’s been little indication from Nevada’s state leaders if lithium production or the regulation of it is a priority.

The Center for Biological Diversity is usually the first organization to criticize lithium projects it feels are harmful, but even it agrees there could be a future for production in Nevada — if done sustainably.

In early February, it submitted a letter to the state’s Standing Committee on Natural Resources, which will consider the center’s proposal to craft a bill that would have researchers study the state’s lithium resources and leaders implement a state rule-making process to prioritize permits that will have less impact on the environment.

“Assuming that Nevadans do not want to sacrifice everywhere in the state to mine lithium, proactive planning for lowest conflict lithium production makes sense,” the center wrote.

The committee is expected to discuss the center’s proposal at one of its upcoming meetings and later decide if it would like to sponsor a bill for the 2025 legislative session.

Contact Alan at ahalaly@reviewjournal.com. Follow @AlanHalaly on X.