Public hearing set on potential Nye County diesel tax

When motorists fuel up in Nye County, most assume that the taxes they are paying at the pump – or at least a portion thereof – go to the county to support its road maintenance activities. While this is true for drivers buying gasoline who pay nine cents per gallon in local gas tax, it’s not the case when it comes to diesel fuel. Every cent paid in diesel tax in what is the third largest county in the U.S. goes not to the local government but to the state of Nevada.

This is something Nye County Public Works has spent the last several years trying to change. After the matter was put to the voters in the 2024 primary election, however, the proposal to establish a Nye County-specific diesel tax was soundly rejected. But Nye County Public Works isn’t letting the subject drop without taking one more swing at increasing funding for its struggling road department.

At the Nye County Commission meeting tomorrow, Thursday, Nov. 21, commissioners will consider a request from public works to implement a five-cent Nye County diesel tax through a vote of the board.

“Nye County does not currently collect any tax on diesel fuel sales,” information included with the agenda item explains. “Nevada Revised Statute 373.062 allows the imposition of a diesel fuel tax not to exceed five cents per gallon in counties with populations under 100,000 with two-thirds majority approval of the members of the board. Eight counties in Nevada (Carson City, Churchill, Humboldt, Lyon, Mineral, Pershing, Storey and White Pine) have already implemented this five-cent tax since March 2020.

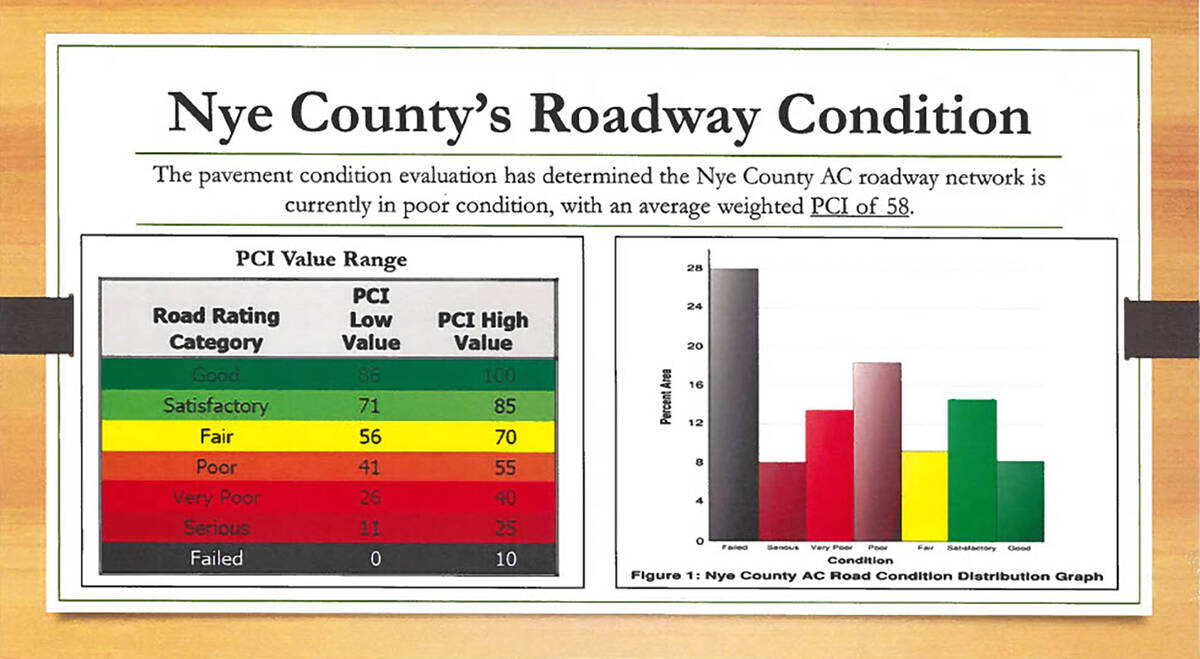

“According to our 2024 streets and highways plan update, with a budget of $2.6 million, it is estimated that the roads will continue to deteriorate,” the agenda item asserts. “To maintain the current Pavement Condition Index in the near term, Nye County should budget $7.5 million per year on maintenance and repair needs.”

That figure is merely to keep the roads at their current condition, which, under the Pavement Condition Index, barely squeaks into the fair category, with a score of 58. In order to improve the PCI to a 71, the lowest value in that category, public works estimates that the road fund would need to be somewhere around $18 million annually.

While a five-cent per gallon diesel tax would certainly not fill this budget gap, it would help bring some extra revenue into the road department.

“This additional funding [from a diesel tax] would allow Nye County to complete more maintenance and construction projects in accordance with our 2024 Capital Improvement Plan – Streets and Highways Plan and 2023 Regional Transportation Commission Streets and Highways Plan Update,” the agenda item states.

Projections show that the diesel tax could raise the road department’s budget by $800,000 or more, with the average increase for diesel drivers ranging from less than a dollar to $5 per fill-up, depending on vehicle type.

Residents can attend tomorrow’s Nye County Commission meeting in person at 2100 E. Walt Williams Drive in Pahrump or 101 Radar Road in Tonopah. Those who cannot attend but who are interested in commenting on the item can do so via teleconference by calling 888-585-9008 and entering conference room number 255-432-824. The meeting can also be watched online at NyeCountyNV.gov

The meeting is set for 10 a.m.

Contact reporter Robin Hebrock at rhebrock@pvtimes.com