Helping keep cash in tax filers pockets

January marks the start of a new year and with the changing of the calendar, residents are starting to ready themselves for tax season. Once they have their W2’s and various other forms in hand, it’s time to start filing but seeking assistance with this process can come with a price tag.

“The average paid-preparer cost is quite high. And they’ll charge you per form, too - schedule C is going to cost you this much, schedule E is going to cost you this much, etcetera. So, going to get your taxes done can easily reach $400 or $500 these days,” Jodi Mobley told the Pahrump Valley Times.

Mobley is the executive director for the Nevada Free Taxes Coalition (NFTC) and its Volunteer Income Tax Assistance (VITA) program.

“Our mission is to empower individuals and families by delivering free, accurate tax preparation and financial education,” information on the organization details. “Through dedicated volunteers and strong community partnerships, we help Nevadans maximize tax credits, overcome economic barriers and achieve greater financial well-being.”

The NFTC has been in existence for 12 years now, Mobley explained, and serves Southern Nevada. “We were approached by the IRS to partner with that agency in operating their VITA program. VITA was started by the IRS over 50 years ago in an effort to save taxpayers money by providing free tax preparation services to low- and moderate-income households,” she said. “For this year’s tax season, the income limit for our program is $69,000.”

As to the NFTC’s efforts in the Pahrump Valley, the organization has been working locally for several years and a large portion of the town’s population is eligible for its services.

“You’ve got almost 50,000 residents there and the median income right now in Pahrump is close to $59,000. That is significantly lower than our $69,000 eligibility limit,” Mobley noted.

Aside from income eligibility, Mobley highlighted Pahrump’s senior population, explaining that roughly 32% of the area’s residents are age 65 or older. While many seniors may feel they do not need to file, as they are not making any income, Mobley said it is key that they do so anyway, to help protect their identity.

“Unfortunately, you should file to protect your identity, if nothing else. That helps you ensure that your social security number isn’t being used by someone else,” Mobley explained. “So, even though many seniors are not required to, we do recommend that they file.”

In past years, the NFTC has had over 100 volunteers spread across 15 Southern Nevada locations but one location that has proven challenging for volunteer recruitment is Pahrump. That’s why, with tax season looming, the NFTC is encouraging all those who are willing to lend a hand in saving their fellow residents some cash to join in.

“Basically, we’re looking for anyone who has a heart to serve. You don’t have to have a career in finance or experience in finance. The IRS provides software that we use as preparers that walks them through the entire process, so there are no guessing games – you’re guided through the whole process,” Mobley added. “We offer training in-person and virtually. If we can get a significant number of interested parties, we will come up there, to Pahrump, to do a training session in-person.”

The training, which consist of basic tax law, takes about 20 hours to complete and covers all aspects of tax returns that are able to be processed by the NFTC. Complex returns are not eligible for this service and volunteers will have a list detailing the precise scope of their work, meaning they will always know whether or not a given return qualifies for NFTC assistance.

The process of becoming a volunteer is straight-forward. Once an application is submitted and reviewed, potential volunteers are contacted by the organization to arrange training. When training is complete, the volunteer is assigned to a location. The number of hours needed from each volunteer varies, Mobley noted, depending on the number of volunteers. More volunteers equals less work for everyone involved.

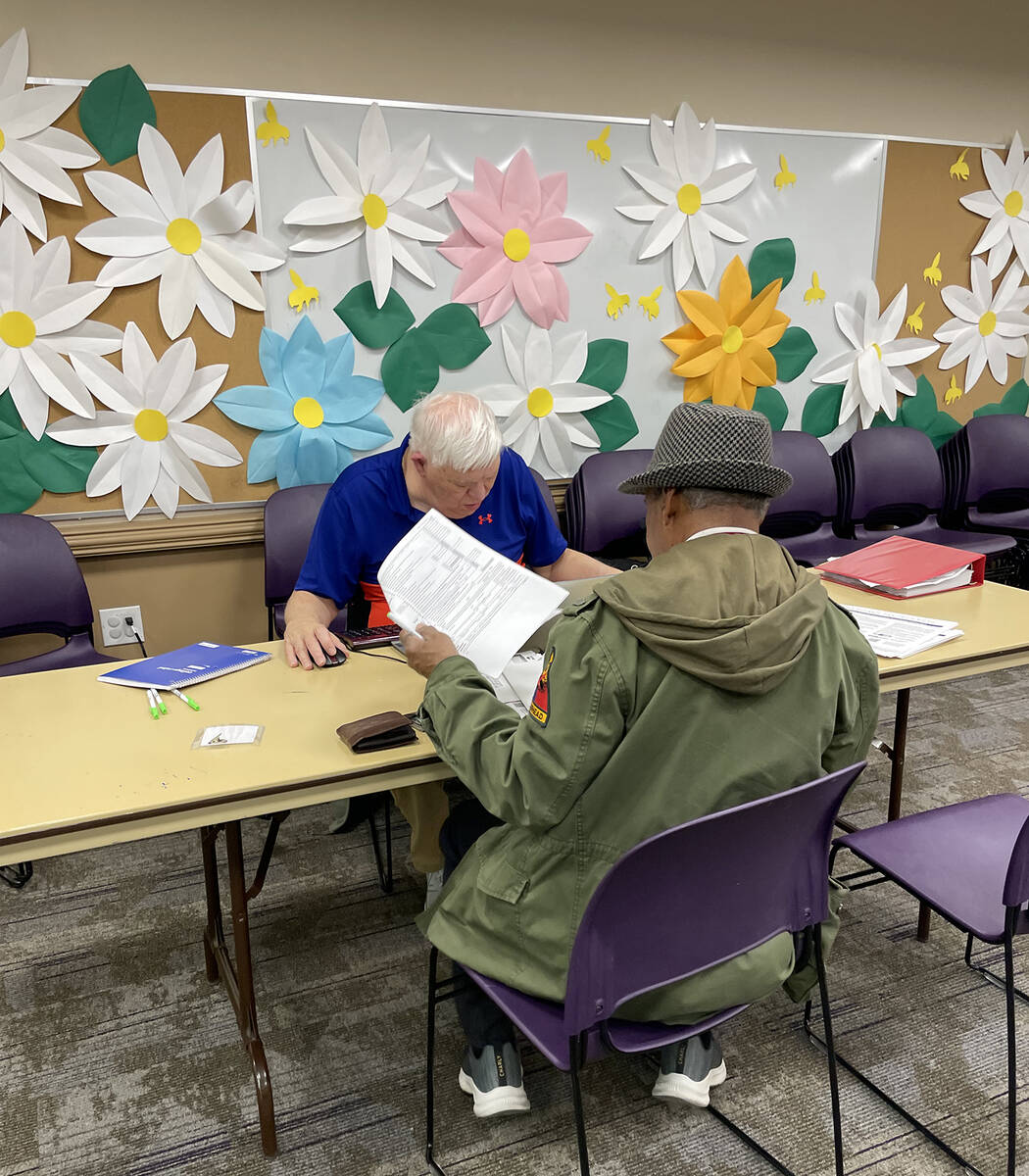

The NFTC initially serves at the Pahrump Community Library. Last year, however, the library was undergoing an extensive renovation project and was closed to the public, so the program moved over the Great Basin College.

“Dr. Chris Salute (director of Great Basin College’s Pahrump campus) has been so kind to us since we changed over to that location, he’s been so cooperative and supportive of our efforts,” Mobley remarked.

Tax preparation will take place on Fridays at Great Basin College from 10 a.m. to 2 p.m. with plans to begin on Friday, Jan 30.

“Join NFTC this tax season to make a difference in your community. VITA sites are a fun, easy way to learn to prepare income taxes while giving back to your community. Our VITA sites are led by local volunteer leaders and focus on supporting our neighbors with a free, personalized tax assistance experience that is enriching and fulfilling not only for them but for us,” the organization’s website states.

For more information or to register to become a NFTC volunteer tax preparer, visit NVFreeTaxes.org or call 702-987-4625.

Contact reporter Robin Hebrock at rhebrock@pvtimes.com