State Attorney General office warns Nevadans to be wary of W-2 scam during tax season

Nevada’s taxpayers are being warned of a new phishing scam targeting a wide range of organizations by collecting W-2 data to file fraudulent tax returns, the state attorney general’s office announced Tuesday.

According to the state, the IRS has reported that scammers will send an email to an employee of an organization who works in human resources that initially appears to be from the company CEO or a corporate executive. Scammers will use various techniques to disguise their email and make it seem like it originated from within the organization, and will ask for copies of the W-2 forms of all employees. The emails typically include language such as: Kindly send me the individual 2016 W-2 (PDF) and earnings summary of all W-2 of our company staff for a quick review; or

Can you send me the updated list of employees with full details (name, social security number, date of birth, home address and salary)?

This information alone may allow criminals to use the employee information to file fraudulent tax returns and claim bogus tax refunds. In addition, scammers might later follow up with an urgent request to transfer a large sum of money to a bank account controlled by the scammer.

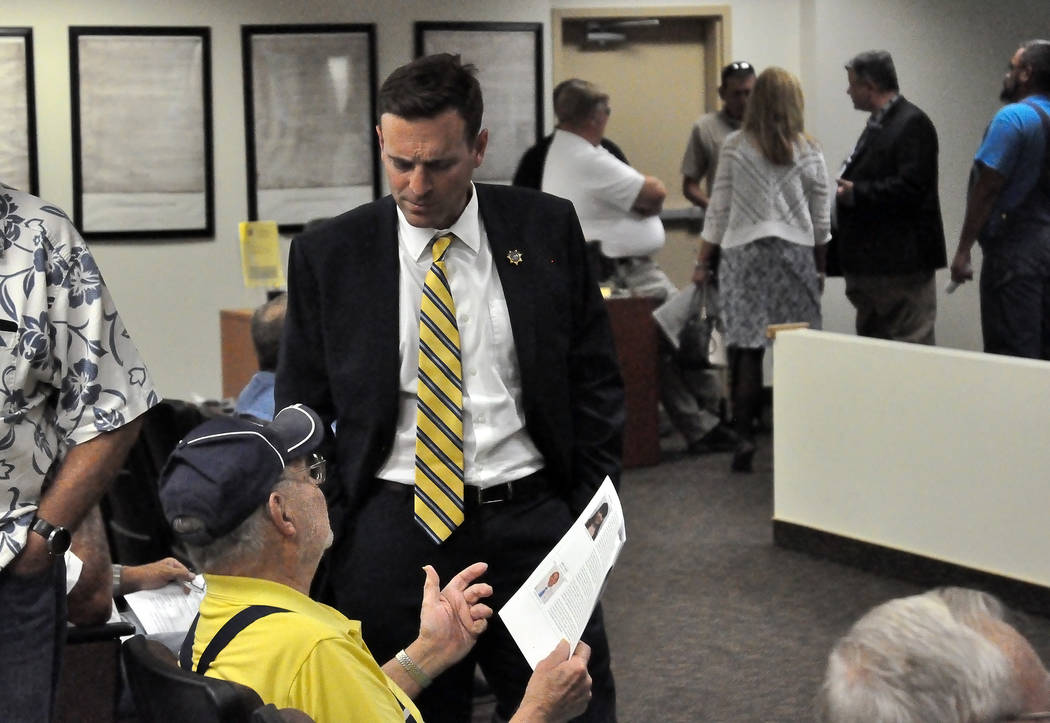

“The IRS considers this W-2 scam to be one of the most dangerous and large-scale phishing scams in recent history,” said Attorney General Adam Laxalt in a release. “During tax season, employees such as human resources and accounting personnel are particularly susceptible to this scam, and I encourage all Nevada organizations to share information about this scam with their employees.”

The Office of the Nevada Attorney General urges all Nevadans to keep in mind that sudden or unexpected requests like this for employee W-2 forms may be disguised and fraudulent emails. Employees should make every attempt to verify such a request by phone to ensure the request is legitimate. All Nevadans are encouraged to file their tax returns as early as possible to avoid falling victim to tax refund fraud.

Organizations who have received a W-2 scam email are encouraged to forward the email to phishing@irs.gov and place “W-2 Scam” in the subject line. Organizations that receive the scams or fall victim to them should file a complaint with the Internet Crime Complaint Center operated by the Federal Bureau of Investigation.

Employees whose W-2 forms have been stolen should review the recommended actions by the Federal Trade Commission at www.identitytheft.gov or the IRS at www.irs.gov/identitytheft. Employees should file a Form 14039, Identity Theft Affidavit, if the employee’s own tax return is rejected because of a duplicate Social Security number or if instructed to do so by the IRS.